Index Portfolio:

Simplify your giving

Simplify your giving

The Index Portfolio simplifies your giving by helping you set a path and easily maintain your charitable fund while it grows. These offerings are a series of broadly diversified, low-cost funds with an all-index, fixed-allocation approach that may provide a complete portfolio in a single fund.

Charitable Investments: Index Portfolio

Learn more about our Index Portfolio

Within the Index portfolio, there are three fund options: the Vanguard LifeStrategy Growth Fund, the Vanguard LifeStrategy Moderate Growth Fund, and the Vanguard LifeStrategy Income Fund.

Watch the video,download the monthly performance report and scroll down for additional information on each option.

Watch the video,

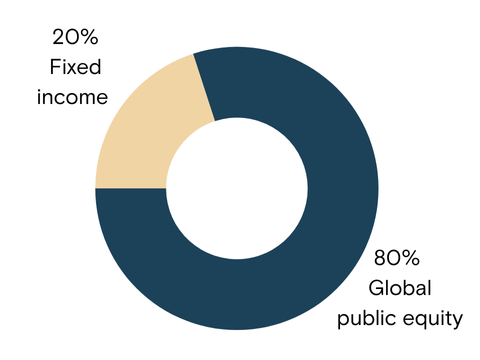

Vanguard LifeStrategy Growth Fund

- 80% Global public equity

- 20% Fixed income

- Asset allocation: 80/20 equity/fixed income

- Expense ratio: 0.14%

- Time horizon: 7 or more years

Vanguard LifeStrategy Moderate Growth Fund

- 60% Global public equity

- 40% Fixed income

- Asset allocation: 60/40 equity/fixed income

- Expense ratio: 0.11%

- Time horizon: 5 to 7 years

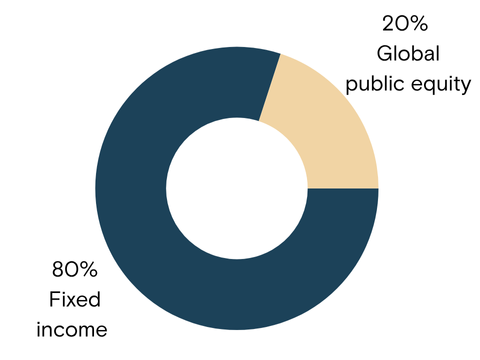

Vanguard LifeStrategy Income Fund

- 20% Global public equity

- 80% Fixed income

- Asset allocation: 20/80 equity/fixed income

- Expense ratio: 0.11%

- Time horizon: 3 to 5 years

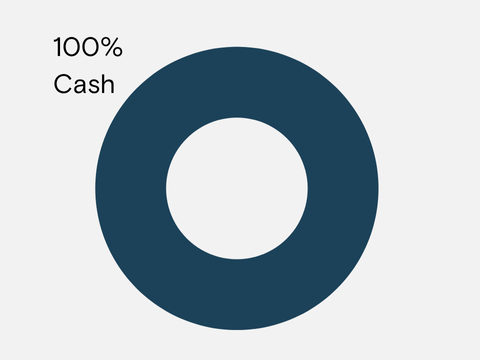

Vanguard Federal Money Market

- 100% U.S. Government securities

- Expense ratio: 0.11%

- Time horizon: 0 to 2 years

While diversification can help reduce market risk, it does not eliminate it. Diversification does not ensure a profit or protect against loss in a declining market. Investing involves risks, including the possible loss of principal.

Performance results will include Thrivent Charitable administrative fees and may differ from the results of the underlying fund.

Performance results will include Thrivent Charitable administrative fees and may differ from the results of the underlying fund.