Thrivent Portfolio:

Sophisticated investments

made easy

Sophisticated investments

made easy

Thrivent’s experienced investment managers build allocations and look for the right opportunities to help the portfolio stay consistent with its objectives. With the Thrivent portfolio you can harmonize your financial and giving goals.

These actively managed funds are made up of stocks and bonds from different sectors, regions and styles—together in a single fund—helping to reduce risk. The funds, each with a different allocation, target various risk-based objectives.

These actively managed funds are made up of stocks and bonds from different sectors, regions and styles—together in a single fund—helping to reduce risk. The funds, each with a different allocation, target various risk-based objectives.

Charitable Investments: Thrivent Portfolio

Learn more about the Thrivent Portfolio

Within the Thrivent Portfolio, there are three fund options: Thrivent Moderately Aggressive Allocation Fund, Thrivent Moderate Allocation Fund, and Thrivent Income Fund.

Watch the video,download the performance summary report

and scroll down for additional information on each option.

Watch the video,

and scroll down for additional information on each option.

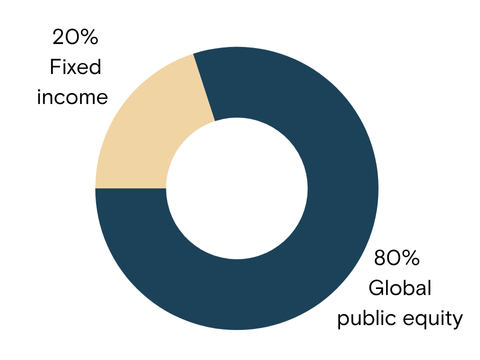

Thrivent Moderately Aggressive Allocation Fund

- 80% Global public equity

- 20% Fixed income

- Asset allocation: 80/20 equity/fixed income

- Expense ratio: 0.89%

- Time horizon: 7 or more years

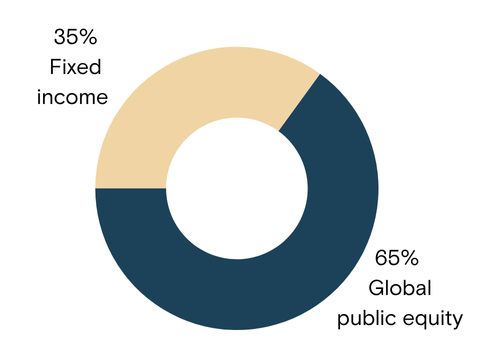

Thrivent Moderate Allocation Fund

- 65% Global public equity

- 35% Fixed income

- Asset allocation: 65/35 equity/fixed income

- Expense ratio: 0.79%

- Time horizon: 5 to 7 years

Thrivent Income Fund

- 100% Fixed income

- Asset allocation: 100% fixed income

- Expense ratio: 0.46%

- Time horizon: 3 to 5 years

While diversification can help reduce market risk, it does not eliminate it. Diversification does not ensure a profit or protect against loss in a declining market. Investing involves risks, including the possible loss of principal.

Performance results will include Thrivent Charitable administrative fees and may differ from the results of the underlying fund.

Performance results will include Thrivent Charitable administrative fees and may differ from the results of the underlying fund.